Summary

In a nutshell

The global picture for the second half of 2025 remains positive for credit markets. The positive stance is explained by resilient economic activity and central bank rate cuts. Risky assets are also receiving support from reduced fears regarding tariffs, alongside robust economic indicators. However, downside risks to growth remain due to high real yields in the United States and rising geopolitical tensions from the ongoing conflict between Israel and Iran, which could influence market stability in the future. The implications for markets will depend on whether the Iranian regime will use oil as a weapon, and whether it will seek to close the Strait of Hormuz, through which more than 20% of the world's oil passes every day.

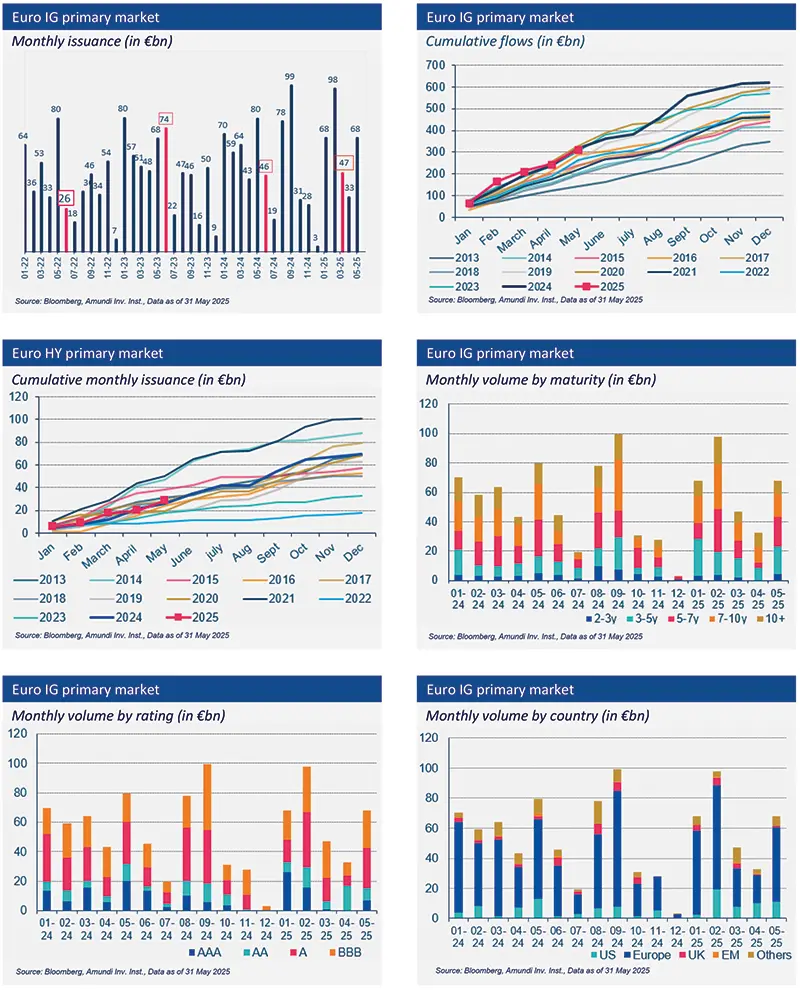

Corporate fundamentals remain robust despite a lower growth backdrop. Indeed, companies have adopted cautious balance sheet management following the COVID-19 pandemic. Moving forward, potential growth impacts could arise from heightened tariffs and overall economic uncertainties. The strong activity on the primary market has allowed companies to easily anticipate their next refinancing needs. The weakness in primary market activity in April following the "Liberation Day" announcements was short-lived.

In this context, default rates should remain contained. The global high-yield default rate decreased to 4.1% in April from 4.5% in March, with European defaults at 2.1% and US defaults down to 5.4%. Current defaults are primarily concentrated in lower-rated high-yield bonds and small to medium enterprises. Moody's assesses a potential decline in global high-yield default rates but cautions that unforeseen shocks could reverse this trend. The outlook for European high-yield rates appears modest, with expectations for a slight increase to around 3%, influenced by a better monetary policy mix and tariff risk management.

Demand for credit products remains strong as investors want to benefit from the level of yield. Demand flows experienced a substantial recovery in May following outflows in April, with a strong performance recorded across both the investment-grade and high-yield sectors in the US and Europe.

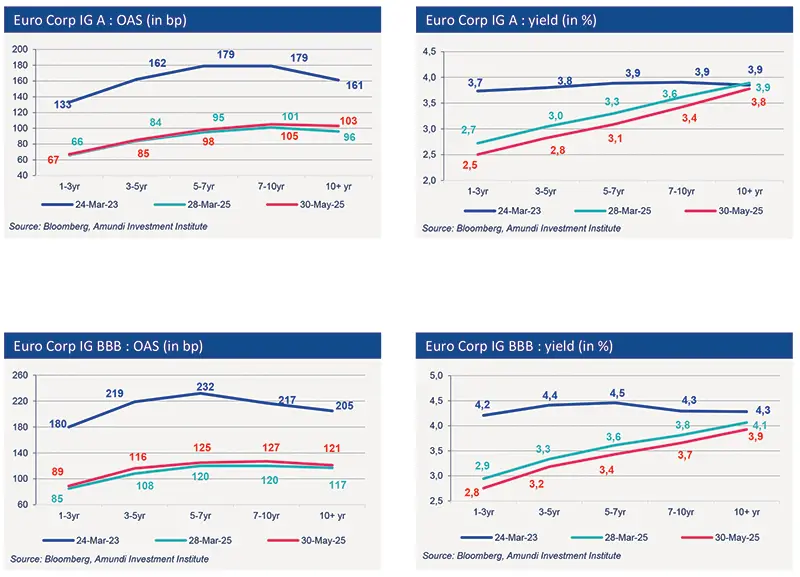

Yields remain anchored at attractive levels. Attractive yield environments are noted for both investment-grade (EU IG: 3.1%) and high-yield bonds (EU HY: 5.4%). However, spreads have almost fully retraced "Liberation Day" widening. Current valuations reflect a fair level for European investment-grade bonds and a bit more expensive for High yield versus historical standards.

Primary market Investment Grade

Market data

Find out about our treasury offer