In conversation with Vincent Mortier, Group CIO, Amundi

In this special edition of Amundi’s Newsletter for Central Banks, we sat down with Amundi’s Chief Investment Officer, Vincent Mortier, to explore the evolving market dynamics. From navigating geopolitical shifts to refining asset allocation strategies, he shares key perspectives on how to identify opportunities in a rapidly changing global landscape.

1. Vincent, how do you assess the current geo-economic environment? What implications do you foresee for asset allocation strategies in the second half of 2025?

The current geopolitical landscape places us in a riskier and more fractured world. While the current US administration is not the cause of the geopolitical shifts underway, it is accelerating them.

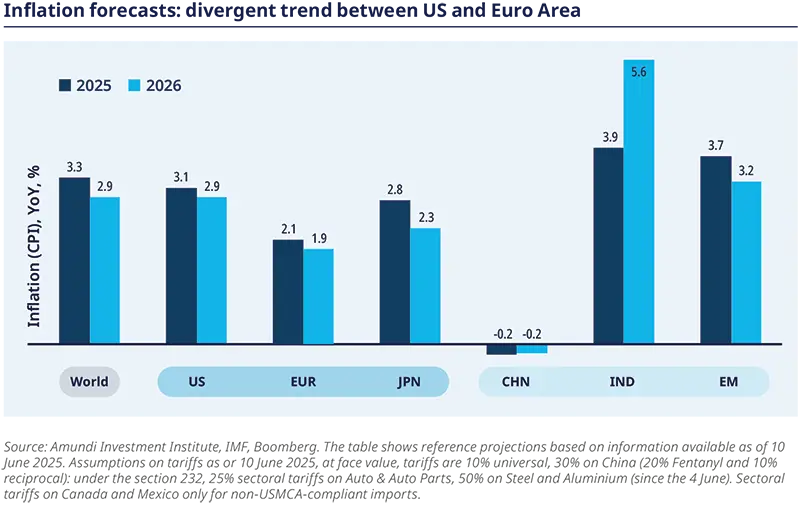

The current level of US political uncertainty, alongside rising geopolitical risk can change how companies, consumers, and investors make decisions. This uncertain backdrop will shape the next twelve months and concerns over the US fiscal position will linger. The economic outlook is the one of a sub-par global growth (slightly below 3% in 2025 and 2026) with divergences at play: a marked deceleration of US growth (at 1.6%), a modest growth for the Eurozone, with a resilient periphery driven by Spain and conversely dragged down by Germany, a recovery of China thanks to policy support, and the confirmation of solid growth in India above 6% both in 2025 and 2026. A fragmented world with geopolitical risks will keep inflation sticky, in particular in the US, where the Federal Reserve can adopt a “waitand- see” attitude, amid decelerating growth and and rising worries over US fiscal trajectory.

While the late cycle is still the dominant phase, incorporating geopolitical insights from historical parallels shows a greater likelihood of polarised outcomes, with potential shifts towards positive recovery phases and a significant probability of negative phases that should be factored into asset allocation decisions. The “new normal” of tariffs may trigger a persistent inflationary backdrop, increasing the risks of adverse inflationary outcomes and therefore highlighting the need for protection.

In this environment, we believe that a “Great Diversification” will play out as companies look to diversify their value chains and trade routes and investors race to broaden their portfolios exposure to limit the impact of high policy uncertainty. While “winners and losers” will not be clear until tariff negotiations and the re-routing process are completed and policy reactions will become clearer, Europe is likely to be a net winner from the uncertainty driven by US administration policies. It is expected to benefit from a renewed emphasis on strategic autonomy and positive investors’ flows, as US exceptionalism is fading.

Against this backdrop, we favour a constructive asset allocation designed to withstand an inflationary regime with high downside risks, particularly in a market where valuations remain elevated. This involves a well-diversified equity approach with a focus on valuations, pricing power, and margins to identify areas best equipped to navigate inflationary pressures. We expect equities to generate low single digit returns in the second half of the year but rotations will continue. Europe’s appeal is likely to become a structural theme favouring small and mid-caps, where valuations remain very attractive. Globally, sector selection will be key. We favour domestic and service-oriented sectors to reduce the risk from tariffs, with a focus on themes such as US deregulation, European defense and infrastructure, and the ongoing Tokyo Stock Exchange reform that will generate a friendly environment for investors.

In fixed income, investors will demand a high premium on US treasuries, amid uncertainty on trade policies, fiscal rising public debt, and huge bond supply. In developed markets, longterm yields will remain under pressure. Central Banks cutting rates will continue to support short-dated bonds, driving yield curve steepening. Investors will look for diversification across markets, favouring Europe and EM debt. Continue to play quality credit, with preference for Euro Investment Grade (financial and subordinated credit).

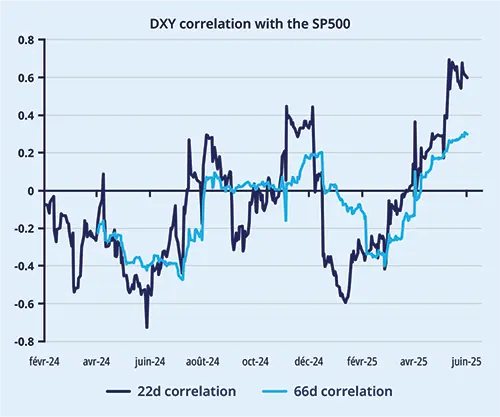

With stagflation risk, hedges against equity downside should also be considered, while commodities and gold are becoming key hedges against hyperinflation risk. We also look at asset classes that thrive in inflationary contexts, such as infrastructure, which offers stable cash flows and benefits from government spending. Foreign exchange (FX) will also play an increasingly relevant role, as changing correlation patterns in the USD will call for higher currency diversification and hedging.

2. Do you still see a growing appeal of gold in asset allocation and in other economic roles?

Yes, we believe that gold could be seen as an island of stability in a sea of uncertainty. Determining whether it remains appealing gets us back to the multiple roles of gold – as a currency, a commodity, an investment asset, a luxury consumption good, and an industrial material.

As a commodity, gold appears expensive, particularly compared to other precious metals. It seems pricey relative to traditional macroeconomic drivers, but not against uncertainty, which makes it fairly priced as an investment asset.

As a consumer and industrial good, gold looks expensive against income or wealth per capita, but cheap against golduser- intensive tech companies. Finally, gold looks very cheap as a currency. Most public liabilities are not backed by tangible assets; instead, they rely on public and market trust, as well as the soundness of economic policies. In the United States, for instance, every ounce of gold now backs $138,000 of public debt compared to less than $500 before the collapse of Bretton Woods. Therefore, the re-rating potential of gold, as a currency, looks significant.

We estimate that global investors currently allocate about 2% of their portfolios to gold, amounting to approximately $4 trillion. This allocation is substantially below what portfolio optimisation techniques suggest. A potential increase to 3% could provide significant upside potential for gold prices. Investors can gain exposure to gold through various channels, including direct investment in gold bullion, gold ETFs, and shares in gold mining companies, which can serve as an appealing complementary option to traditional gold investments and remain cheap in relative terms.

3. Do you see a rebalancing from US assets into other asset classes? If so, which assets could benefit from this rotation?

US policy uncertainty is making investors cautious, especially on exposure to US assets, but also on exposure to countries and markets that may be hit hard by US tariffs.

We have seen a rotation towards European equities, both from non-residents but also from European investors moving money back from their US investments. This is seen in both active and passive fund strategies and among sectors, where there is added impetus on defence stocks fuelled by the expected fiscal stimulus to increase defence spending.

We have also witnessed inflows to Emerging Markets (EM), which have proved resilient so far this year, while outflows have been very low compared to late last year, partly due to the dollar correction and lower US ten-year rates. Within EM, equity markets have been more resilient, especially in Latin America that is less affected by tariffs. Investors are attracted by valuations in EM, including in local-currency debt markets.

Beyond this rotation currently underway, large changes in the pattern of capital flows will depend on the ability of non-US markets to absorb large flows. Relative to what is currently held in US markets, this capacity to absorb is limited. The overvaluation metric, which has characterised parts of the US market, could soon be an issue for other markets as well. This will act as a limit, unless we see a major correction in US Treasuries, that, in turn, would lead to disorderly and disruptive changes in capital flows and asset prices.

4. What is driving the US Treasury market? Can it still be considered as a safe haven?

The US Treasury market has historically been viewed as a safe haven for investors, but recent developments are prompting a re-evaluation of this status. Several factors are influencing its dynamics, which may impact its reliability as a refuge during economic uncertainty.

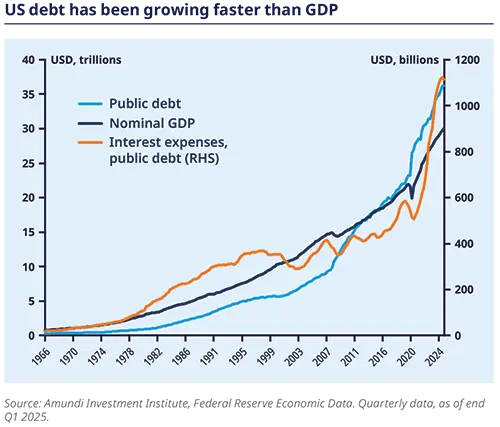

One significant driver is the increasing policy-induced uncertainty stemming from high levels of US debt and lower global growth. With approximately 40% of sovereign debt needing to be refinanced in the next two years, concerns about financial stability are mounting. The recent tariff announcements by President Trump have further rattled markets, leading to volatility in Treasury yields. Initially, yields fell as investors sought safety amid recession fears, but as inflation expectations rose, longerterm yields rebounded sharply.

The supply of US Treasuries is also a critical factor. The United States has been running substantial fiscal deficits since the start of the century: federal debt as a share of GDP has increased from 56% in 2000 to 124% at the end of 2024, leading to higher bond issuance. This growing supply, coupled with declining demand from the Federal Reserve (due to quantitative tightening), should exert upward pressure on yields. If large foreign investors also reduce their holdings, Treasury yields could rise even more relative to swap rates. In the absence of a fall in the swap rate, this could push US nominal yields higher.

Despite these challenges, US Treasuries still hold a unique position in the global financial system. They are considered a benchmark for risk-free assets and play a crucial role in pricing many dollar-denominated securities. The liquidity and stability of the Treasury market make it an appealing option for investors seeking to mitigate risk, especially during periods of market turbulence.

However, the perception of Treasuries as a safe haven may be changing. The recent sell-off in the Treasury market, driven by fears of higher inflation and a deteriorating fiscal outlook, suggests that investors are becoming more cautious. If the market stays under pressure and yields rise due to concerns about credit quality or fiscal sustainability, investors may look elsewhere for safety.

In conclusion, while the US Treasury market is currently facing significant challenges, it retains its status as a key player in global finance. However, the evolving economic landscape and shifting investor sentiment may prompt a re-evaluation of its role as a safe haven in the future. As policy uncertainty persists and global growth slows, the dynamics of the Treasury market will be closely monitored by investors seeking stability in an increasingly complex environment.

5. Do you expect the dollar dominance to fade? And what could be the scope for further FX diversification?

The question of whether dollar dominance will fade is increasingly relevant in today’s economic landscape. While the US dollar has long been the cornerstone of global finance, recent trends suggest a possible gradual shift towards diversification in FX markets.

One indicator of this potential de-dollarisation trend is the rising term premia in US Treasuries and the recent weakness of the dollar. These developments reflect a growing caution among investors regarding US assets in the long term. For instance, the increase in swap spreads and the term premium, particularly at the long end of the yield curve, indicate that investors are becoming more cautious to hold onto US securities. This shift is compounded by the fact that foreign ownership of US dollar assets reached a record $31 trillion in 2024, yet many institutional investors maintain low hedge ratios, suggesting a growing appetite for diversification.

Despite these signs, it is essential to note that de-dollarisation will be a long and complex process. The US dollar still accounts for nearly half of all SWIFT transactions and US equity and bond markets represent the dominant share of global markets. However, as investors increasingly seek to mitigate risks associated with dollar dependency, the scope for FX diversification is expanding.

Emerging markets, particularly India and China, are gaining traction as viable alternatives for investment. The growth gap between emerging and developed markets favours the former, and currencies from these regions may benefit. For instance, the Chinese yuan should remain supported, as policymakers are unlikely to devalue it, given the potential repercussions on international trade relations.

Moreover, the changing correlation structure of the dollar, which now shows a positive correlation with equities, suggests that investors may need to reassess their currency exposure. As the United States faces rising fiscal risks and a potential growth slowdown, the attractiveness of US assets may diminish, prompting a reallocation towards European equities and emerging markets.

In conclusion, while the US dollar is unlikely to lose its dominance overnight, the signs of a gradual shift towards FX diversification are evident, with investors increasingly looking beyond the dollar, exploring opportunities in emerging markets and alternative currencies. This evolving landscape presents both challenges and opportunities for global investors as they navigate the complexities of a changing economic order.

Discover how to ride the policy noise and shifts with

Amundi's Mid-Year Outlook

Find out more on Sovereign entities