Summary

Highlights

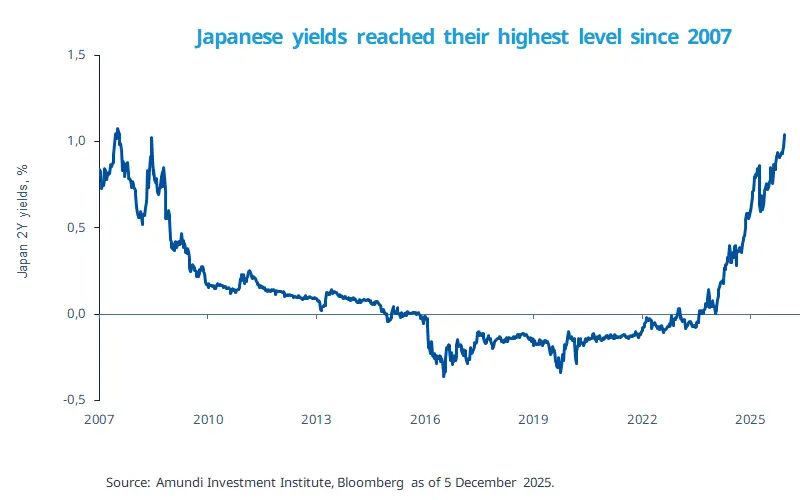

2Y bond yields rose to their highest level since 2008 on hopes of a rate hike by the BOJ.

We maintain our projection of a BOJ rate hike of 25 bps later this month and another similar move next year.

Rising yields in the long term might increase the appeal of local bonds for Japanese investors, who currently find foreign bonds more attractive.

In this edition

Yields on Japan’s two‑year bonds touched their highest levels since 2007, on market expectations of a rate hike later this month. While the short end (2‑year) is more sensitive to policy‑rate moves, yields on 10‑year and 30‑year bonds have also risen amid concerns about the government’s expansionary fiscal policy and high public‑debt levels. The Bank of Japan (BOJ) aims to control inflation and to signal its independence to markets. The BOJ would also like to control the pace of any sudden yen depreciation through credible policies, and it seems the Bank has convinced the Takaichi administration of this. We continue to expect a rate rise in December and another around mid‑2026. The timing will largely depend on exchange-rate developments, as economic fundamentals appear to be mature enough to warrant further tightening. Additionally, we believe that even after this expected hike, financial conditions are likely to remain accommodative.

*Fiscal expansion/easing refers to an increase in government spending and/or reduction in taxes to stimulate economic growth

Key dates

EZ Sentix investor confidence, NY Fed inflation expectations |

FOMC rate decision, Brazil Selic Rate, China CPI |

Germany CPI, France CPI, India CPI |

Read more