Summary

In this edition

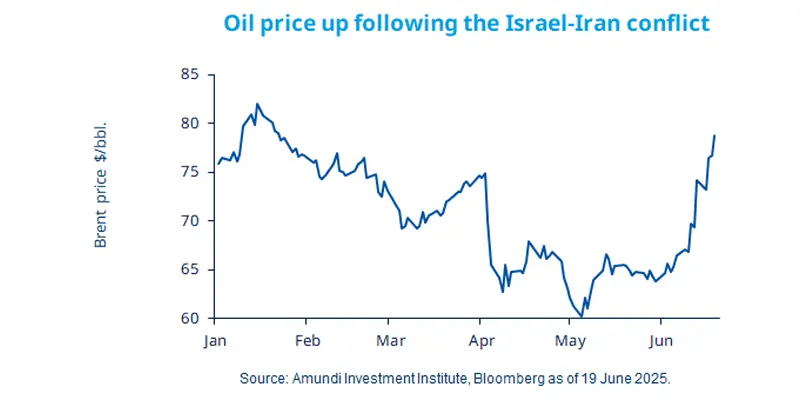

The conflict between Israel and Iran has brought to the fore the market’s concerns about oil supply, causing prices to jump sharply to their highest level since January. Apart from the human cost, this conflict further complicates the global economic environment. Central banks such as the Fed are trying to, and have so far been successful in, controlling inflation. However, such conflicts, ambiguous tariffs, and lengthy trade negotiations complicate the outlook. The Fed’s decision to keep rates unchanged is an acknowledgement of these uncertainties, including the effect of tariffs on inflation. It will likely resume rate cuts later this year, as inflation subsides. There is one caveat, though – sustained high oil prices (not our base case) and the conflict expanding may reignite inflationary pressures. In any case, investors should stay diversified* and vigilant.

Highligts

- Oil prices have risen on concerns over supply disruptions following the conflict, with some ripple effects in equities.

- As the situation is still fluid and evolving every day, we expect oil volatility to continue.

- High volatility and uncertainty call for a tilt towards quality assets including bonds which could provide stability.

Key dates

23 June US home sales, PMI – EZ, US, UK, Japan, India |

26 June US durable goods, Bank of Mexico policy rate, Brazil inflation |

27 June US PCE, EZ consumer confidence, China industrial profits |

*Diversification does not guarantee a profit or protect against a loss.

Read more