Summary

Highlights

For now, the ECB is in a 'good place', with services inflation remaining high and activity data improving more than expected.

The Eurozone macroeconomic outlook points to decelerating growth and further disinflation this year.

- European equities are supported by a benign macroeconomic outlook, while fears of a potential hawkish pivot from the ECB appear to have been dampened.

In this edition

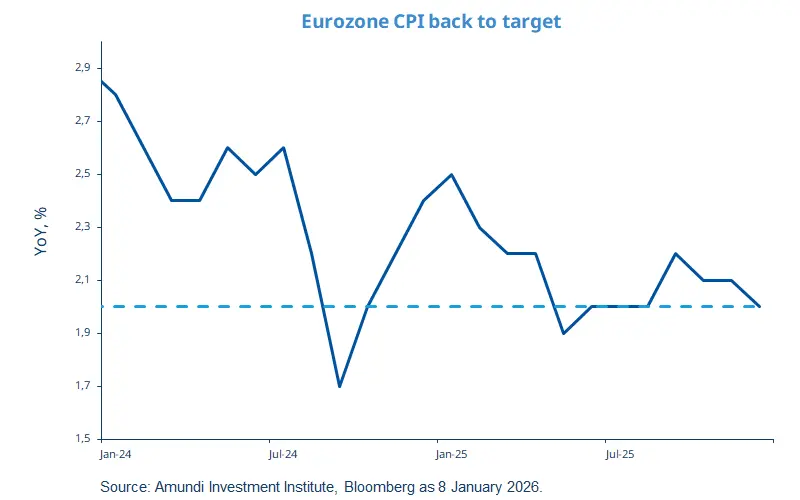

Eurozone inflation slowed to 2.0% in December, according to a preliminary estimate, hitting the ECB's 2% target for the first time since August. We expect inflation to stay below this target both this year and next year, while real GDP growth should slow overall in 2026 despite the recent positive momentum. Growth forecasts were upgraded, while inflation still signals a deceleration due to sluggish private consumption, slowing wage growth, and further euro appreciation (which tends to make exports cheaper).

This environment is supportive of European equities, and German equities recently hit new all-time highs. We believe the ECB will adopt a ‘wait-and-see’ approach in early 2026 and communicate a data-dependent stance. Conditions for further rate cuts to materialise would include a combination of moderating services inflation, subdued consumption, and softer-than-expected economic growth. Weak credit growth in the region and a stronger euro may also prompt the ECB to take action.

Key dates

US CPI and new home sales, Japan current account |

China trade balance, US retail sales and existing home sales |

US industrial production, Brazil business confidence |

Read more