In a nutshell

In recent days, there has been an increase in volatility: assets such as cryptocurrencies and major artificial intelligence stocks have experienced significant fluctuations. The uncertainty regarding the Fed's ability to reduce its rates next month has also weighed on the markets. Fed officials may pause the rate-cutting cycle due to the difficulty in gauging the actual state of the American economy, given the lack of published data following the shutdown. During the first half of November, credit spreads experienced a slight increase.

However, we believe that the context remains favourable for credit markets.

Economic activity in the United States and Europe remains resilient. The economic data published continues to positively surprise investors. We forecast economic growth of nearly 2% in the United States for 2026, while in the eurozone, it should stabilise around 1%.

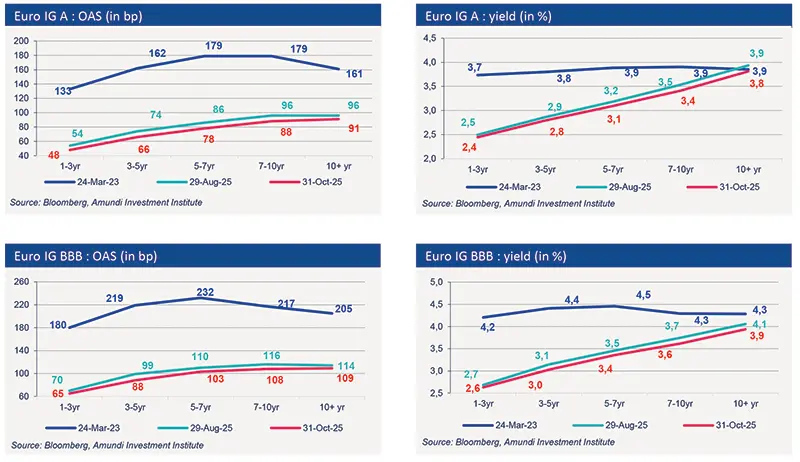

Additionally, we believe that the Fed and the ECB will continue their rate-cutting cycle. We anticipate a terminal rate for the Fed at 3.25%, in the context of slowing labor market conditions. We also expect two further rate cuts from the ECB, in contrast to the market, which is convinced that the rate-cutting cycle is nearing its end.

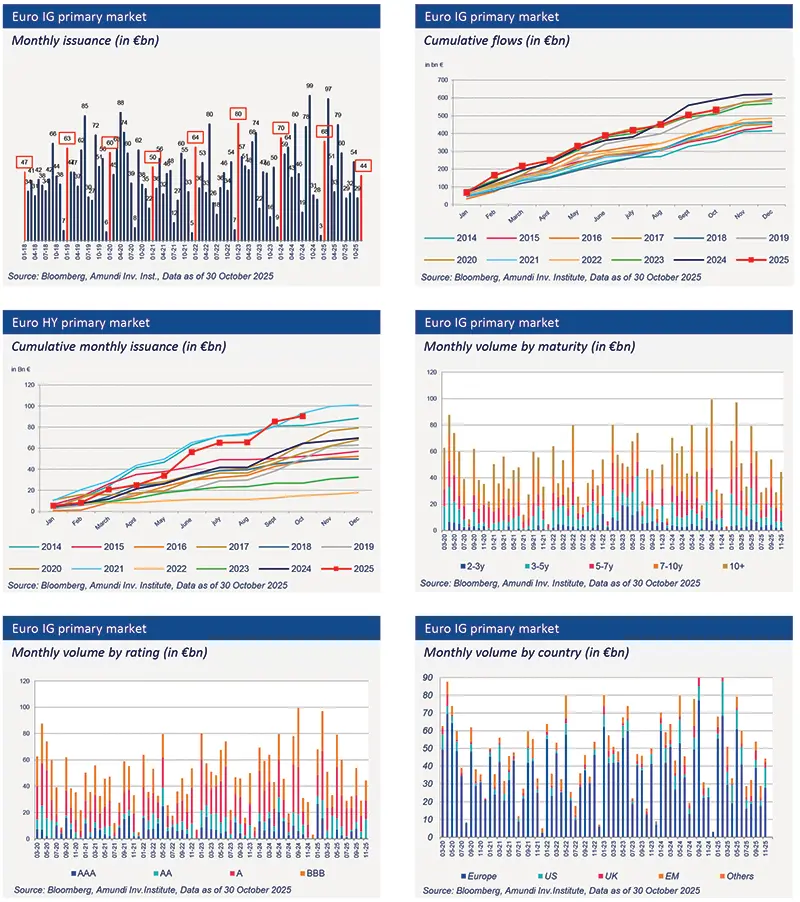

These rate cuts will have a positive impact on credit by providing more liquidity to this asset class. Demand remains strong in the American and European credit markets, with a focus on quality: investors are seeking yield alternatives in light of falling short-term rates. To watch: the financing needs of American companies that could increase significantly with a rise in investments, mergers and acquisitions.

Primary market Investment Grade

Market data

Find out about our treasury offer